Overview

The Income Tax Return is in which the taxpayer files information about their income earned and tax applicable to the income tax department.

Goals

These APIs provide you with basic details of a taxpayer's income tax return. It gives you the ability to read income, deductions, etc. and prepare income tax returns.

Specifications

● Income Tax Return API is very efficient, trusted and, hence, is fully capable of operating in such institutions.

● When PaySprint’s Income Tax Return API is used, you just have to enter the ITR number and the system will give you the ITR outcomes.

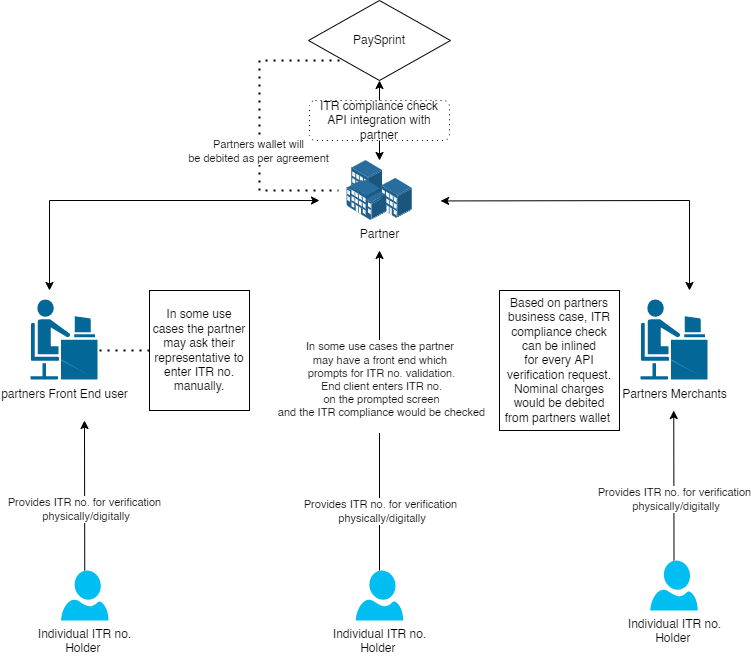

Steps Involved

- Partner will integrate the ITR Download API.

- Use case of the Download API would be defined by the partner itself

- A individual would be providing his/her ITR number to the merchant, or in some cases, the merchant itself will provide the ITR number to the partner

- After entering the requested details, the ITR would be checked and, in response, the partner would get the below mentioned Authentication API Outcomes.

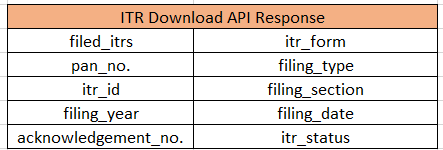

Authentication API’s Outcome

- filed_itrs: ITR numbers you have entered

itr_form: Which type of form you used

pan_no.: PAN number of the ITR filer

filing_type: Type of ITR form

itr_id: Unique identification number of ITR

filing_section: Under which section of ITR this comes

filing_year: In which year ITR has filed

filing_date: On which date ITR has filed

acknowledgement no.: Unique number of the ITR download

itr_status: Status of the ITR filing

Process Flow