Overview

With GST law implementation, all registered taxpayers are combined into one single platform for compliance and administration purposes and are assigned a unique registration number, i.e., a unique Goods and Services Tax Identification Number (GSTIN) controlled and managed by the single authority.

Every business that crosses the threshold limit prescribed under this act must register with the government

Goals

Gst Verification API is very efficient, trusted and hence, is fully capable of operating in such institutions. When you use our GST Verification APIs for the same, you just have to enter the GSTIN number and the system will give you the result for the company associated with the GSTIN number.

Specifications

● Gst verification API is straightforward and integration is effortless. We Provide a simple and user-friendly interface.

● The process will save any institution that has been or can be a victim of fake GSTIN holders. The GSTIN verification API will easily detect such fraud.

● Our system checks the information from the GSTIN department. Therefore, the results are always correct and legit.

Steps Involved

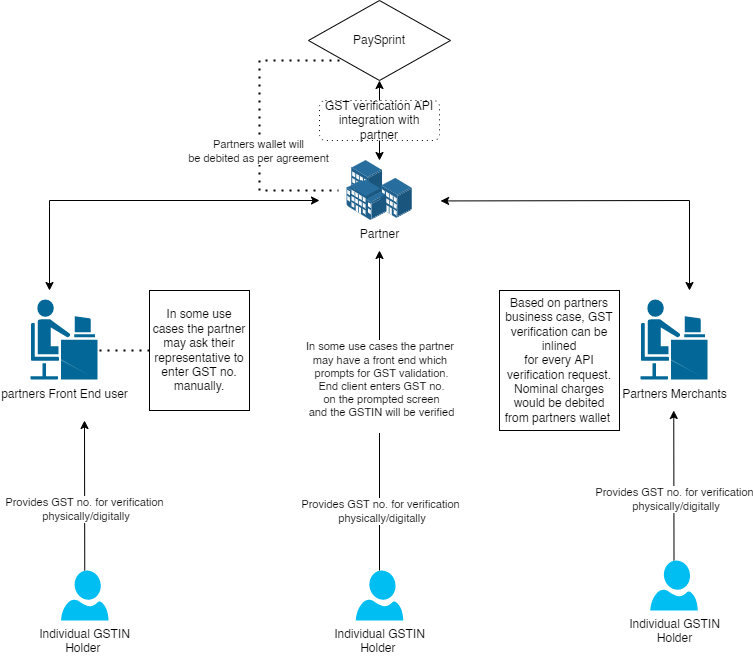

- Partner will integrate the GST verification API.

- Use case of verification API would be defined by the partner

- To check the authenticity of GST number, One need to insert only GST number

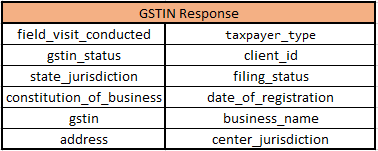

- After entering the requested detail the GST IN would be verified and in response the partner would be getting the below mentioned Authentication API Outcomes.

Authentication API’s Outcome:

Process Flow